Purpose, Types, and Glossary of Common Invoice Terms

As a business owner, you have an understanding of the important documents that connect you to your customers and suppliers. Invoices not only help you collect payment fro your clients, invoices also can provide vital insights into your other internal and external processes.

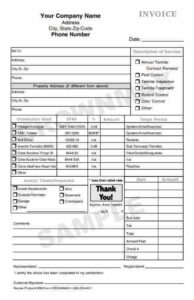

Link to example: 2690 – Invoice

What is an invoice?

An invoice is a document given to the buyer by the seller to collect payment. An invoice includes the cost of the products purchased or services rendered to the buyer.

Is an Invoice a Legal Document?

An invoice is not a legal document on its own. While invoicing is an important accounting practice for businesses, invoices do not serve as a legally binding agreement between the business and its client.

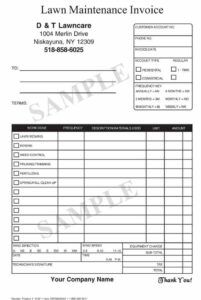

Link to example: 4122 – Lawn Maintenance Invoice

In order to create a legally binding agreement, an invoice must be accompanied by a legally valid contract. To be considered legally valid, a contract only needs to include two important elements. These are the two requirements that must be met for a contract to act as a legal document:

- All parties involved must agree to an offer that is made by one party and accepted by another.

- Something of value must be exchanged for something else of value, which can include goods, services and cash.

Common Types of Invoices

While all invoices contained specific elements, they can come in many shapes and sizes. The common types of invoices include:

- Standard Invoice

- Interim Invoice

- Pro Forma Invoices

- Commercial Invoices

- Recurring Invoices

- Final Invoices

- Past Due Invoices

Some of these invoice types seem straightforward enough. It’s easy to imagine what a “past due invoice” might be. However, there’s a good chance that you’ve never encountered a few types of these invoices, or that you aren’t sure what defines them.

Let’s consider the definitions and uses of each of these invoices.

Standard Invoice

A standard invoice is a professional document, including an itemized list of the goods and services provided, the costs of those goods and services, and the payment terms for these goods and services. A standard invoice is usually very straightforward and convenient.

A standard invoice can include invoices between people, rather than companies or corporations. Like many aspects of the world of invoicing, the standard invoice is defined by both what it is and what it isn’t. The rest of this list includes other non-standard invoices, which help bring clarity to what makes one standard.

Interim Invoice (or Progress Invoice)

An interim invoice (or progress invoice) is used in situations in which the work stretches over a long time span from start to finish. An interim invoice will be sent at regular or intermittent dates throughout the project to both update the customer on the project and to get payments from the customer.

Website projects, construction projects, and other large-scale ongoing projects will use interim invoices, assuming that the customer understands what the progress looks like and is comfortable paying throughout the project.

One risk of interim invoices is that some customers will be surprised by paying for progress, particularly if they are not used to receiving progress invoices for the type of work for which they are paying. Interim invoices are only recommended if the customer is comfortable with them and if it makes sense in the context of the project.

For an extreme example, a progress invoice for a restaurant bill or car repair would exceedingly confuse the customer and damage the relationship irreparably (or result in a good laugh.) On the other hand, a progress invoice for a major construction project would make perfect sense to all parties involved.

When should I use progress invoicing?

There are several key advantages for using progress invoices, including:

- Keeping customers abreast of progress: The greatest advantage of progress invoicing is that customers will have a thorough understanding of the work’s progress.

- Income for the supplier: Progress invoicing isn’t just advantageous for one party. The customers will be kept in the loop for progress, while the supplier will have income throughout the project. Additionally, employees and subcontractors will have consistent income throughout the process.

When should I not use progress invoicing?

There are a few risks inherent in progress invoicing:

- Potentially inappropriate and irrelevant: In many situations, progress invoices simply don’t make sense. As noted above, progress invoices are a natural fit for many projects. For others, they make no sense and would do serious damage to the professional relationship. (Again, imagine if you received a bill for your appetizer before the entrée had arrived.)

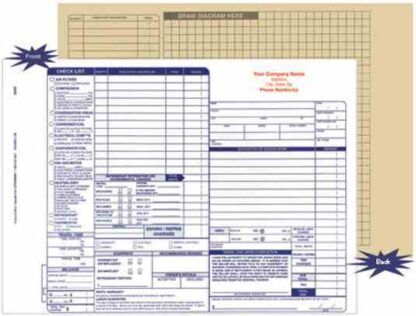

Still not sure what an interim invoice looks like? An interim invoice can have all the makings of a standard invoice but used with a different intent and sometimes different verbiage. It’s all in the wording like on this contractor’s invoice form that can be used as an interim invoice – modify the terms and use the check mark to denote whether it is to be paid in full or partial.

Pro-Forma Invoices

A pro-forma invoice is sent from the supplier to the client in advance of the final delivery of goods or services. Unlike a quotation, a pro-forma invoice is typically a binding agreement for the purpose of approving both work and prices.

While a binding agreement, pro-forma invoices are also subject to change. A pro-forma invoice is not presented with the expectation of payment, but to provide the necessary information for parties to move forward with the work appropriately.

Caution is advised when using pro-forma invoices, as clients will expect the final invoice to closely resemble the prices provided on the pro-forma invoice.

Pro-forma invoices are also relevant in the use of foreign trade (see “Commercial Invoices” below for more information.)

When should I use pro-forma invoicing?

When considering using pro-forma invoicing, it’s important to understand the advantages:

- Establish pricing: There’s nothing worse than an invoice that arrives as a shock to anyone involved. A pro-forma invoice eliminates this nightmare from becoming a reality, by clarifying the expected ultimate price.

- Establish expectations regarding work: In addition to the prices, the itemized goods and services in an invoice should not come as a surprise for anyone. Identifying them during the pro-forma invoice is a great opportunity to add some clarification around what work will be provided.

- Binding agreement: Pro-forma invoices are binding agreements, while simultaneously allowing room to change and evolve over time.

When should I not use pro-forma invoicing?

It’s important to consider the risks in pro-forma invoicing:

- Potential confusion for the customer: If poorly communicated, a pro-forma invoice can be mistaken as either a quotation or a contract. When pro-forma invoicing is used, it’s crucial that all parties understand exactly what is occurring.

- Project drift: This is a larger issue than something that can be solved here and now, but many pro-forma invoices can be made irrelevant when the project changes scale.

To put it plainly, a pro-forma invoice is a confirmed purchase order that ensures the buyer and seller agree to the services being rendered.

Commercial Invoice

A commercial invoice might sound like any invoice between two businesses. However, it has a specific, significant meaning when used in foreign trade. In the context of international trade, a commercial invoice indicates a customs declaration provided by the exporting party.

Commercial invoices must include all the aspects of a standard invoice, while additionally including appropriate identification numbers, notes, comments, and information on the country (or countries) of origin.

In general, it’s smart to leave the words “commercial invoice” out of regular invoicing conversation, unless it’s for the specific purpose of foreign trade. If someone requests a commercial invoice from you, it’s appropriate to immediately ensure that all the rules and regulations for the relevant countries are being followed.

Finally, please note that, in many cases, commercial invoices are not for payment. They accompany trades as documents ultimately used for taxation purposes. There should still be a separate standard invoice that covers that payment aspects, while this covers the trade regulations and taxations aspects.

When should I use a commercial invoice?

If dealing with international trade and customs, a commercial invoice is not an option that can be pondered or voted against. If a commercial invoice is required—and, if you’re wondering, then it probably is—then you’d better use a commercial invoice.

When should I not use a commercial invoice?

Commercial invoices are not something to be treated lightly. It’s important to understand that, in most cases, a commercial invoice is not for payment. A commercial invoice template should be carefully used in the construction of the appropriate documentation.

Recurring Invoice

A recurring invoice is an ongoing, often automatic invoice provided for ongoing goods or services. One of the major advantages of recurring invoices is that they can be a way to automatically charge customers.

Recurring invoices do not make sense for one-time projects. They are also not to be mistaken for progress invoices or interim invoices, which are used in situations for large scale projects.

SaaS software, subscription services, ongoing utilities, and other monthly or annual services are typically covered by recurring invoices.

When should I use a recurring invoice?

Use recurring invoices when providing any kind of ongoing service. For an example that almost everyone is familiar with, consider Netflix or Spotify, both paid through automatic monthly payments. These are not literally recurring invoices—as recurring invoices are not automatic payments, often still requiring work on the receiving end—they are very similar in nature.

When should I not use a recurring invoice?

Recurring invoices are often inappropriate for project-based work. Even for major projects, a better option is to opt for interim invoices (or progress invoices) rather than recurring invoices.

Final Invoices

The final invoice occurs at the end of a project. A final invoice should reflect the payment expected by the customer, while reiterating the provided goods and services.

Recurring invoices and final invoices are often mutually exclusive, as a final invoice will be provided at the end of a project and a recurring invoice will be provided for an ongoing service without an established end date. However, one might say “final invoice” when referring to the last in a series of recurring invoices.

When should I use a final invoice?

When the job is done and you’re ready to get paid. This one is simple, straightforward, and relatively unambiguous.

When should I not use a final invoice?

When things aren’t final. This is something serious to consider: don’t jump the gun and send the final invoice before the projects are complete, just as you don’t want to pay a final invoice before you’re satisfied with the work.

Past Due Invoices

Past due invoices are exactly what they sound like: invoices sent to professionally remind customers that payment is still expected. No one ever wants to send or receive a past due invoice, but they are an unfortunate reality of the world we live in.

For more on the unfortunate past due invoice, see the “What Happens When Invoices Aren’t Paid?” section below.

When should I use a past due invoice?

When they haven’t paid and you’re concerned they won’t pay without another invoice.

When should I not use a past due invoice?

This one is simple: don’t use a past due invoice unless the payment is legitimately past due. Again, this is why you date your invoices and use clear payment terms. You could create some serious trouble if you start sending past due invoices preemptively.

Glossary of Common Invoice Terms

Net 0/15/30/45/60/90

Whenever you see “Net” followed by a number, it’s referring to the payment terms. It means the net amount of the invoice is due within that number of days. So, if a client tells you they pay on a Net30 schedule, it means they’ll pay the full balance of the invoice within 30 days of receiving it. Net0, on the other hand, typically means the invoice is due the same day it’s received.

On receipt

“On receipt” is another type of payment term that means the same thing as Net0. If an invoice is due on receipt, that means it should be paid the same day it’s received.

Bill to

The “Bill to” portion of an invoice identifies the company or person you’re sending the invoice to—usually your client or customer. In the Bill to section, you should include:

- The company name

- The company’s main address

- The name of either your primary contact at the company or the person who will approve payment

- The same person’s email address and/or phone number

Billing vs. invoicing

While you can find some variation between the terms “billing” and “invoicing” depending on who you talk to, most people typically use both terms interchangeably referring to sending clients or customers a description of the products or services used and the charges incurred.

Recurring invoice

Recurring invoices are simply invoices that are sent out regularly for the same amount. If you’re a freelancer working on a monthly retainer, for example, you may send out a recurring invoice for the retainer rate each month.

Itemized

Instead of listing one total cost, an invoice that’s itemized breaks down each product or service and its individual price. For example, an itemized invoice might look something like this, with each service listed as a line item:

- Service A: $100

- Service B: $42

- Service C: $185

Line item

On an itemized invoice, each service or product is listed on its own separate line. Each of these is referred to as a “line item.”

Purchase order

Some clients or customers may require a purchase order from their own accounting or financing department that helps them identify your charges. If requested and provided by the client, including the purchase order (PO) number on your invoice can help streamline and expedite approval and payment.

Accounts payable (AP)

Accounts payable can refer to a few different things. For one, it’s the name of a type of account in a business’ general ledger. The AP account records the money a business is liable to pay in the short-term (like supplier or contractor invoices). AP can also refer to the department within a company that deals with making payments like those.

Accounts receivable (AR)

Similar to AP, accounts receivable (or AR) is a type of account in a business’ general ledger—this one records the money a business is owed (like an outstanding invoice awaiting payment).

Audit trail

An audit trail refers to the written records that accompany a given accounting transaction. Audit trails are most often used to verify the accuracy of payments and accounting entries, and any relevant invoices are considered a part of the audit trail.

In conclusion: Invoicing is an essential aspect of business, and companies should be familiar with the various types of invoices to use them appropriately.

To view the Crownmax invoice forms for a specific industry, please click on one of the following links: Pest Management, HVAC Plumbing, Cleaning, Lawn Care, Locksmith or Miscellaneous.